Posts tagged stocks

Leaving Scottrade for Good Now, This is Why

Feb 12th

Ironic how my last blog was titled, “How Scottrade Won My Business Back“, but this time around, I’m definitely leaving Scottrade and no longer recommending it to others. More >

How Scottrade Won My Business Back

Jan 7th

About ten months ago I wrote a blog critical of Scottrade titled, The Reasons I’m Leaving Scottrade. Fast forward to today and I’m happy to report that Scottrade has been able to turn things around, at least from my perspective, and keep me as a customer. In my article I had outlined three key factors in my article regarding why I was leaving Scottrade:

- Lack of DRIPs

- Dissolution of FocusShares ETFs

- Check Writing Discontinued / Scottrade Bank Issue being forced on customers to withdraw funds via ACH

Scottrade is Forcing Customers to Use Scottrade Bank

Mar 15th

A couple of days ago I received an email from Scottrade notifying me that my check writing privileges for my brokerage account were being terminated due to inactivity for over a year. They nicely recommend that I open a Scottrade Bank Account instead. Ironically, I just recently signed up for check writing privileges about two months ago and have actually used it.

What the local branch says

I called my local branch office to see what the deal was. I was informed by the local representative at the branch that Scottrade is actually phasing out and cancelling all debit/check cards and check writing privileges for their brokerage accounts. Not quite the message I get from the email I received, but I can see why they’re doing this on the down low. The representative briefly tried to up-sell me on opening a Scottrade Bank Account where I can transfer funds easily. Here’s the thing though…

I really don’t need another bank account. I’ve actually been trying to reduce my number of accounts. I have too many bank accounts and do not want to add another one to the list. Currently, to withdraw funds from my brokerage account, I initiate an ACH transfer from my personal checking account with another institution that I’m completely happy with. Now that Scottrade is removing check writing/ACH privileges from the brokerage account, I would have to open up a Scottrade Bank account, then transfer from my brokerage account to my Scottrade Bank account, then initiate an ACH transfer from my personal checking account.

It’s one more step and one more thing to keep a track off that I shouldn’t have to. There are many brokerages out in the market that offer ACH transfers. Some time ago I wrote about how Scottrade implemented a transfer-out fee for the first time in years. Now I know why they did. I explained my opinion to the local rep on the phone and although he didn’t come straight out and agreed, he did say, “I definitely understand and let me just put it this way… I have been made aware [by managers] that this is a growing concern and ummm… well I’ll just leave it at that.” So there’s definitely been some resentment among other customers at Scottrade.

I’m out…

I for one will be transferring my account to another brokerage. There’s plenty of other brokerages out there that are willing to cover my transfer-out fees. Overall Scottrade has been good to me for the past several years, but I’m not liking this new direction they’re taking.

Scottrade is Raising Fees and Adding a Transfer Fee

Sep 11th

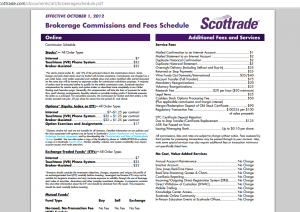

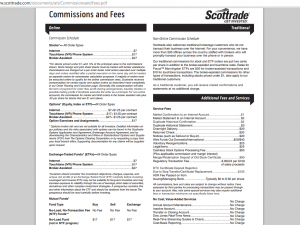

Today I received a notification in my Scottrade account of a new brokerage commissions and fees schedule. According to their message:

Effective Oct. 1, 2012, we are updating our Commissions and Fee Schedule. Please note that no changes have been made to commissions for orders entered online.

Overall their statement is true. Price increases are seen for IVR phone system (almost doubling) and broker-assisted orders. Online stock and ETF orders remain at $7. Their mutual fund rates remain the same as well.

However if you look closely at their Service Fees, you’ll see an increase in many of their services plus one additional one: Account Transfer (Full Transfer) for $75.

Scottrade was not charging for account transfers till now. Don’t get me wrong, I still like Scottrade and they do have some of the lowest commissions out there. In addition, all the other major online brokerage firms were charging transfer fees already ranging from $60-$75:

- Schwab: $70 fee

- Ameritrade: $75 fee

- eTrade: $60

- Scottrade: $75 (used to be $0)

So it’s no surprise Scottrade decided to add a transfer fee. A transfer/closing fee would really only affect you if you were switching from one brokerage to another or closing out your account completely. I just found it interesting how there was no mention of the additional fee without digging into their fee schedule.

Overall I still enjoy Scottrade and won’t be switching. However I will be considering opening an account at Ameritrade given their extensive list of no-commission free ETF’s including Vanguard; I’m just not sure if I’ll be jumping into the ETF marketing any time soon. My portfolio has grown to the point where I feel I can diversify adequately and gain a better return than an ETF.

If you’re looking to getting started at Scottrade with some extra free trades, feel free to use my referral code:

Monthly Investment Portfolio Update: Still Outperforming DJIA & S&P

Jun 16th

My investment portfolio keeps beating the Dow Jones, S&P 500, and the NASDAQ which I’m overly happy about. The act of investing in certain industry-specific ETF’s has developed a diversified portfolio that at the same time can be some-what aggressive.

My investment portfolio keeps beating the Dow Jones, S&P 500, and the NASDAQ which I’m overly happy about. The act of investing in certain industry-specific ETF’s has developed a diversified portfolio that at the same time can be some-what aggressive.

Although my portfolio has done well as the stock market overall hasn’t been having a great time these past couple of months, I wonder if my portfolio will keep outperforming the major indexes as the stock market recovers. My current hypothesis is that the performance of my portfolio may not outperform the indexes during a time of significant growth due to my hedge strategy holdings in the utilities sector. About 30% of my portfolio is in the financial sector which has attributed to a good portion of my gains these past couple of weeks, so that’s been encouraging and may keep my portfolio in a state of outperforming the indexes during a growth period.

Surprise, Surprise, Netflix Takes Big Hit on Stock

Sep 19th

I wonder if Mr. Reed Hastings saw this coming 10 weeks ago. It was exactly 10 weeks ago on July 11, 2011, that Netflix was polishing and preparing to send out an email to their millions of subscribers the following morning letting them know of the price increase. At that time, Netflix (NFLX) had a stock price of $289.14 per share. The day after, on July 12, 2011, Netflix announces its price increase and failed at damage control. About seven and a half weeks later, Netflix announces that they’re losing Starz. At only 17 days after that, Netflix CEO gives his apology but with a twist in the form of Qwikster. So what do the shareholders think of this? More >