Money

Leaving Scottrade for Good Now, This is Why

Feb 12th

Ironic how my last blog was titled, “How Scottrade Won My Business Back“, but this time around, I’m definitely leaving Scottrade and no longer recommending it to others. More >

How Scottrade Won My Business Back

Jan 7th

About ten months ago I wrote a blog critical of Scottrade titled, The Reasons I’m Leaving Scottrade. Fast forward to today and I’m happy to report that Scottrade has been able to turn things around, at least from my perspective, and keep me as a customer. In my article I had outlined three key factors in my article regarding why I was leaving Scottrade:

- Lack of DRIPs

- Dissolution of FocusShares ETFs

- Check Writing Discontinued / Scottrade Bank Issue being forced on customers to withdraw funds via ACH

Deliberating My Scottrade Decision

May 1st

This past month I’ve been pondering my decision to leave Scottrade. I opened up an account with TradeKing (If you register for TradeKing through this link, we both get $50) mostly based on positive reviews about their customer service and their good pricing on trades and options. Now that my balances are higher, I’ve slowly been increasing my trading activity. I haven’t dived into option trading just yet but with regular trades at $5, I’ll be saving about 28.5% in transaction fees… not much if it’s only like two to three trades per month but my volume is heading towards the 10-20 trades range.

My Initial Reactions to TradeKing

Registering and signing up was easy as well as transferring funds via ACH. In fact, you don’t have to open a bank account with TradeKing to do ACH transfers (unlike Scottrade). So far, I spend most of my time in TradeKing Live. As I get a bit more free time, I’ll imagine that I’ll qualify for TradeKing Quotestream in the next couple of months or so. But for now, I have mixed feelings about TradeKing Live. TradeKing Live is an ajax based web application and although it seems to be live streamed data, I do get a slight feeling of sluggish responsiveness. Perhaps I’ve just really gotten used to Scottrader Streaming Quotes.

What Sways Me – Scottrader Streaming Quotes

I’ve really enjoyed using Scottrader Streaming Quotes. It’s a Java based application and it can be customized to a great degree plus it feels very responsive compared to TradeKing Live. I like the fact that I can pretty much do everything in Scottrader Streaming Quotes, including push updates on the latest headlines and being able to view tick-by-tick orders; something you can’t do in TradeKing Live (or at least I haven’t figured out how). TradeKing Quotestream may change this for me, but I won’t be able to take it for a test drive until I qualify for it with a minimum of 10 monthly trades.

So far, my disappointment with TradeKing Live in comparison to Scottrader Streaming Quotes is what’s swaying me to keep my account open at Scottrade for now. However, I’m still going to stick with TradeKing as well for their lower transaction fees. If I had all my trading funds and securities with Scottrade, I would qualify for ScottradeELITE and take that platform for a test drive but for now funds are split between TradeKing and Scottrade.

Summary

I’m currently staying with both, Scottrade and TradeKing. I’m envisioning using Scottrade for my long-term investments (although their lack of DRIP is still a big negative) and using TradeKing for my short-term stock/option trading.

On a side note and in full fairness, Scottrade did email me with a correction and notified me that I will be keeping my ACH withdrawals. I do not have to open a Scottrade Bank account to simply do ACH withdrawals… so that’s a big plus that has helped me sway my position as well.

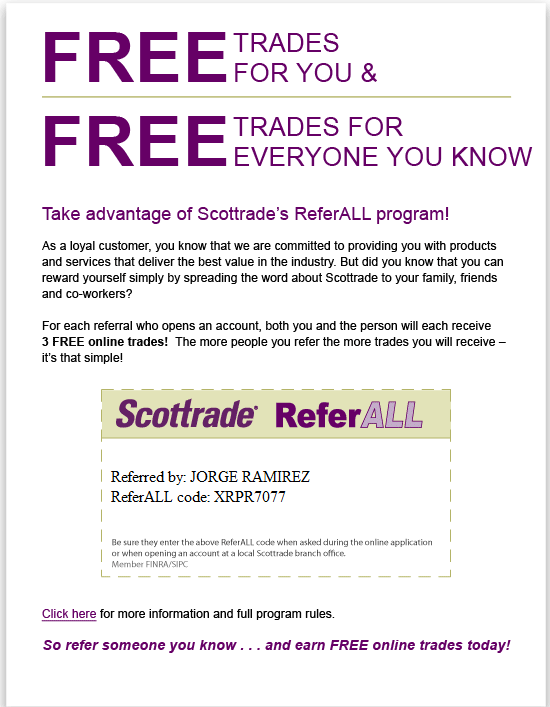

Give Scottrade a spin and with my referral code, get 3 free trades:

The Reasons I’m Leaving Scottrade

Mar 19th

So it seems my recent blog, Scottrade is Forcing Customers to Use Scottrade Bank, has gathered quite a bit of interest from friends, colleagues, readers, and especially Scottrade. Since posting my blog on March 15, 2013, I’ve been contacted by Scottrade via phone by the local branch manager and via Twitter by what I’m assuming is Scottrade’s PR department/agency. In fact, Scottrade has also followed me on Twitter.

Now that I’ve gathered such attention from Scottrade, I feel I need to expand upon my reasons for leaving in hopes that my criticisms and feedback can be taken constructively and used to improve the experience of existing and future customers. More >

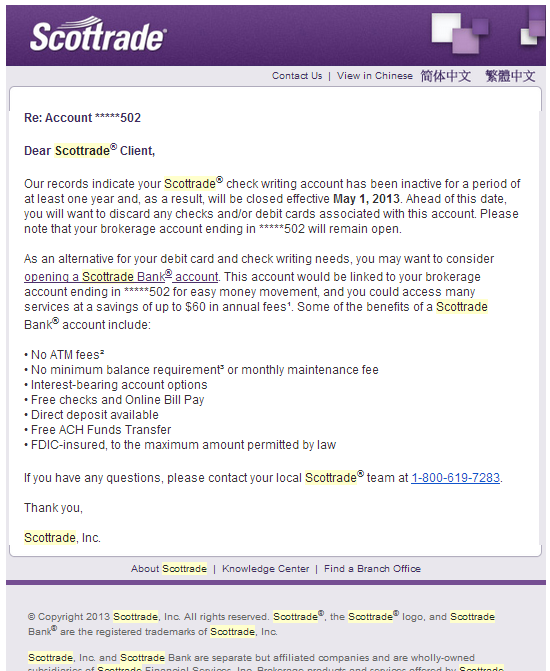

Scottrade is Forcing Customers to Use Scottrade Bank

Mar 15th

A couple of days ago I received an email from Scottrade notifying me that my check writing privileges for my brokerage account were being terminated due to inactivity for over a year. They nicely recommend that I open a Scottrade Bank Account instead. Ironically, I just recently signed up for check writing privileges about two months ago and have actually used it.

What the local branch says

I called my local branch office to see what the deal was. I was informed by the local representative at the branch that Scottrade is actually phasing out and cancelling all debit/check cards and check writing privileges for their brokerage accounts. Not quite the message I get from the email I received, but I can see why they’re doing this on the down low. The representative briefly tried to up-sell me on opening a Scottrade Bank Account where I can transfer funds easily. Here’s the thing though…

I really don’t need another bank account. I’ve actually been trying to reduce my number of accounts. I have too many bank accounts and do not want to add another one to the list. Currently, to withdraw funds from my brokerage account, I initiate an ACH transfer from my personal checking account with another institution that I’m completely happy with. Now that Scottrade is removing check writing/ACH privileges from the brokerage account, I would have to open up a Scottrade Bank account, then transfer from my brokerage account to my Scottrade Bank account, then initiate an ACH transfer from my personal checking account.

It’s one more step and one more thing to keep a track off that I shouldn’t have to. There are many brokerages out in the market that offer ACH transfers. Some time ago I wrote about how Scottrade implemented a transfer-out fee for the first time in years. Now I know why they did. I explained my opinion to the local rep on the phone and although he didn’t come straight out and agreed, he did say, “I definitely understand and let me just put it this way… I have been made aware [by managers] that this is a growing concern and ummm… well I’ll just leave it at that.” So there’s definitely been some resentment among other customers at Scottrade.

I’m out…

I for one will be transferring my account to another brokerage. There’s plenty of other brokerages out there that are willing to cover my transfer-out fees. Overall Scottrade has been good to me for the past several years, but I’m not liking this new direction they’re taking.

How I Got $125 Bonus for Opening a Checking Account with ING Direct

Nov 23rd

You know me, I’m always keeping an eye out to make best use of my finances. Today I received an email from ING Direct about their Black Friday Special… $125 for opening a checking account. I’ve had my savings accounts with ING Direct since I was a teenager. Today’s interest rates have barely any return, but ING Direct is still leaps higher than the big mortar banks. Additionally, I love their web interface. It’s fairly easy to add additional savings account. I set up a sub-account for each one of my goals.

You know me, I’m always keeping an eye out to make best use of my finances. Today I received an email from ING Direct about their Black Friday Special… $125 for opening a checking account. I’ve had my savings accounts with ING Direct since I was a teenager. Today’s interest rates have barely any return, but ING Direct is still leaps higher than the big mortar banks. Additionally, I love their web interface. It’s fairly easy to add additional savings account. I set up a sub-account for each one of my goals.

So how do you get an extra $125? Easy (no huge deposit required)… just make 10 purchases with the debit card they send you. From the looks of it, there’s no minimum purchase per transaction so I’m planning on buying some small lunches to meet my minimum. If you don’t have a checking account yet with ING Direct, open one up by Sunday, Nov 25 and be on your way on earning an extra $125. Also if you use my referral link below, you gain an additional $25 if opening a savings account as well. So overall, you walk away with a $150 bonus.

Click here to Open an ING Direct Account and Score Your Bonus

Scottrade is Raising Fees and Adding a Transfer Fee

Sep 11th

Today I received a notification in my Scottrade account of a new brokerage commissions and fees schedule. According to their message:

Effective Oct. 1, 2012, we are updating our Commissions and Fee Schedule. Please note that no changes have been made to commissions for orders entered online.

Overall their statement is true. Price increases are seen for IVR phone system (almost doubling) and broker-assisted orders. Online stock and ETF orders remain at $7. Their mutual fund rates remain the same as well.

However if you look closely at their Service Fees, you’ll see an increase in many of their services plus one additional one: Account Transfer (Full Transfer) for $75.

Scottrade was not charging for account transfers till now. Don’t get me wrong, I still like Scottrade and they do have some of the lowest commissions out there. In addition, all the other major online brokerage firms were charging transfer fees already ranging from $60-$75:

- Schwab: $70 fee

- Ameritrade: $75 fee

- eTrade: $60

- Scottrade: $75 (used to be $0)

So it’s no surprise Scottrade decided to add a transfer fee. A transfer/closing fee would really only affect you if you were switching from one brokerage to another or closing out your account completely. I just found it interesting how there was no mention of the additional fee without digging into their fee schedule.

Overall I still enjoy Scottrade and won’t be switching. However I will be considering opening an account at Ameritrade given their extensive list of no-commission free ETF’s including Vanguard; I’m just not sure if I’ll be jumping into the ETF marketing any time soon. My portfolio has grown to the point where I feel I can diversify adequately and gain a better return than an ETF.

If you’re looking to getting started at Scottrade with some extra free trades, feel free to use my referral code:

Sometimes a Deal isn’t a Deal on Daily Deal Sites Like Groupon and LivingSocial

Sep 2nd

I just received an email on today’s LivingSocial Deal for a “Shazzam Tsunami Rechargeable Electric Hydroflosser with Included Shipping“:

LivingSocial claims a 72% savings. So you would think this is definitely a great deal. Imagine getting something for $64 that was originally $231. However this is clear deception because I found the exact same product on Amazon.com for less… a lot less… almost half of the LivingSocial deal.

You can get the Professional Rechargeable Oral Irrigator with High Capacity Water Tank by ToiletTree Products on Amazon.com for a mere $39.95.

As the group discount sites deal with slower traffic and businesses that are realizing that it may not be to their benefit, they’re are desperately trying to turn an income by no longer delivering value to their target base; which ironically will be the demise of these group coupon sites. I feel for the 142 and counting people who have purchased the inferior LivingSocial Deal.

Recently I’ve turned my attention to FatWallet who’s overall goal is to deliver value to their target base. I also found a very strong community of people who are actively looking for value in their purchases. I would say, put these “Groupon” sites on the backburner and give FatWallet a try… perhaps you’ll find real value instead of a “deal” that’s not really a deal.

Monthly Investment Portfolio Update: Still Outperforming DJIA & S&P

Jun 16th

My investment portfolio keeps beating the Dow Jones, S&P 500, and the NASDAQ which I’m overly happy about. The act of investing in certain industry-specific ETF’s has developed a diversified portfolio that at the same time can be some-what aggressive.

My investment portfolio keeps beating the Dow Jones, S&P 500, and the NASDAQ which I’m overly happy about. The act of investing in certain industry-specific ETF’s has developed a diversified portfolio that at the same time can be some-what aggressive.

Although my portfolio has done well as the stock market overall hasn’t been having a great time these past couple of months, I wonder if my portfolio will keep outperforming the major indexes as the stock market recovers. My current hypothesis is that the performance of my portfolio may not outperform the indexes during a time of significant growth due to my hedge strategy holdings in the utilities sector. About 30% of my portfolio is in the financial sector which has attributed to a good portion of my gains these past couple of weeks, so that’s been encouraging and may keep my portfolio in a state of outperforming the indexes during a growth period.

My Stock Portfolio Minimized Losses

May 18th

May so far has not been a great month for the stock market. As of earlier this morning, the S&P is down almost 7% for the month of May. I should consider myself lucky given that I’ve only lost about 2-3% in the same time period. With recent happenings in the market, here’s my current outline and thoughts on where my portfolio is and what to consider: