Archive for September, 2012

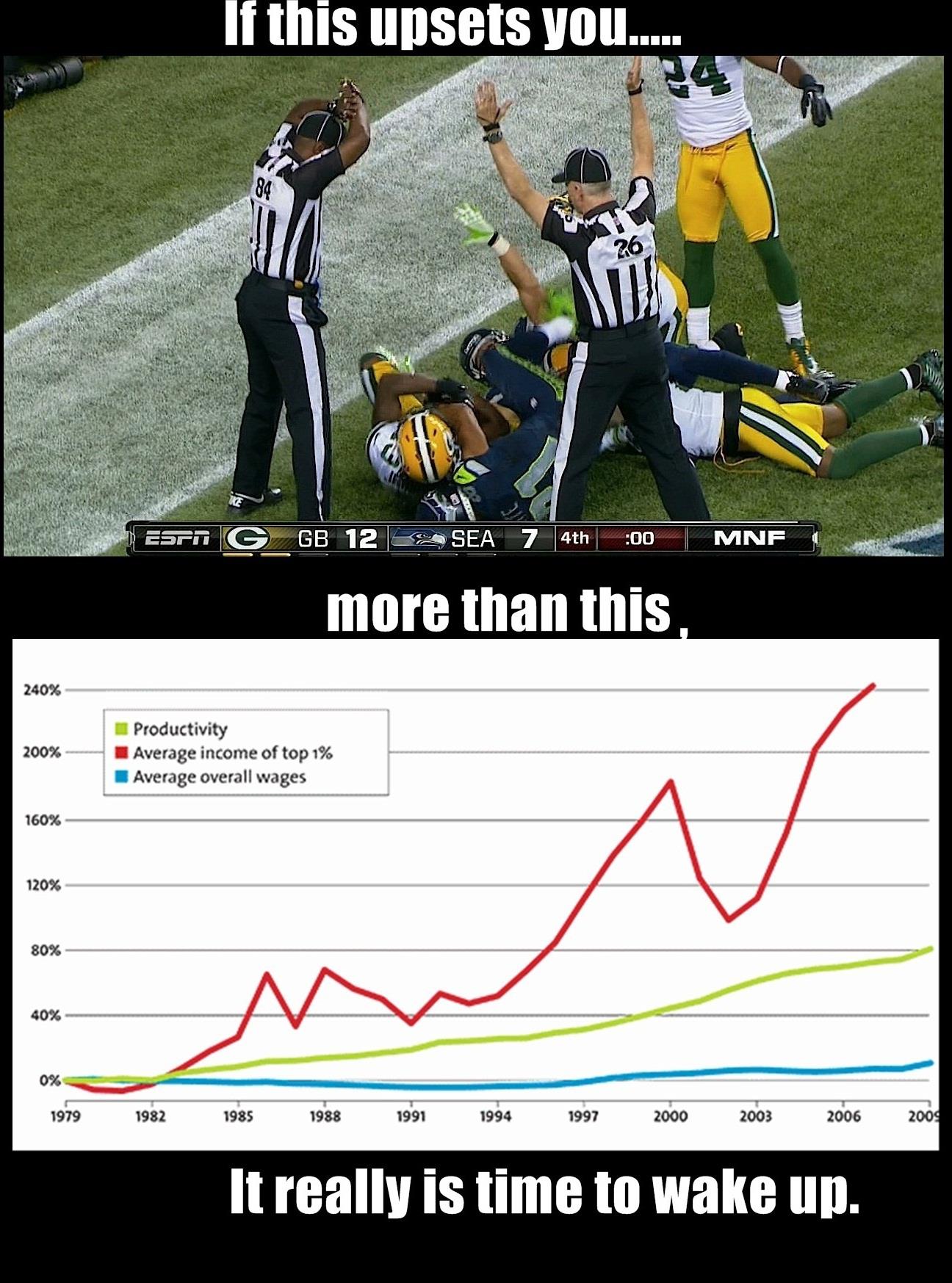

Putting Things Into Perspective – Top 1% Average Wages vs Others

Sep 30th

A friend recently shared this photo on Facebook from the Reaganomics, Raping America since 1981 Facebook Page that engaged me in further thought.

The photo was posted with the following listed as raw data sources: http://www.census.gov/

I took an interest on the statement the photo was proposing and further research caused me to respond.

First off… to be honest I’d say that I’m a moderate that slightly leans conservative but it really depends on the subject. When it comes to earnings, I’m a believer that we must take self-responsibility for our wealth. In the same light, the greater the risk the greater the reward should be.

Overall I couldn’t find a chart like the one posted in the photo in the raw data sources. I did find a similar chart in a recent news publication that for some reason used the “mean” of top 1% and the “median” of overall wages to compute the chart. There’s a big difference between mean and median. The fact that two methods were used to represent data in the same chart is misleading. Why is this important? Because even in the top 1%, there’s a big skew. According to Forbes, in the US, the richest person’s net worth is $66B; that’s almost 3x as much as the 10th richest. A median computation would take into account this kind of skewed data… a mean would not. I’m sorry, but this chart is misleading.

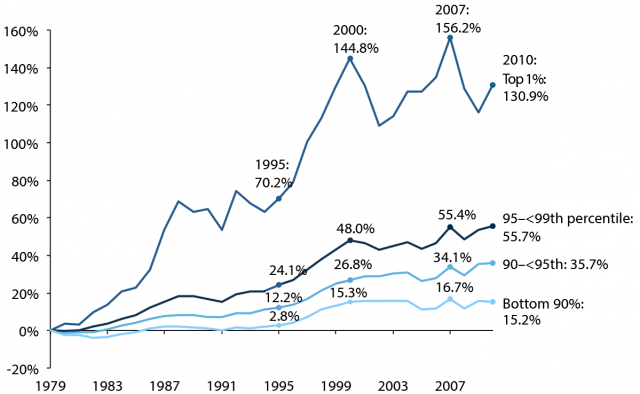

However, I’m not dismissing the general statement of this graph that top earners have had a greater increase in revenue than average households. I feel that further analysis is required to form a solid conclusion on the why. For example, the charts only take into account wages/earnings and not benefits (health insurance, vacation, expense accounts, etc) Nonetheless, greater risk should come with greater rewards. Let’s reference a chart found in the same source mentioned in raw sources (www.stateofworkingamerica.org) which shows a similar pattern as the graph in the first chart but the top line is not skewed. In addition, the later percentages are compounded by earlier years. I would like to take a relative measure to prove a point… from 2001 to about 2002, the top 1% had a decrease of about 30% in earnings while the <90% had no change in their wages. From 2000 to 2007, top 1% only had a 1% increase in earnings while <90% had a 9% increase. From 2007 to 2009, top 1% had a decrease of 16% while <90% had a decrease of 9%. In the lost decade, from 2000 to 2010, top 1% had a decrease of 9.5% in annual revenue while <90% had lost less than 1% (pretty much no change). I’m not denying the fact that top 1% have increasingly earned more, but the fluctuations for the top 1% are greater. Top 1% earners tend to be heavily invested in businesses and markets. These investments inherently carry great risk of potentially losing capital. <90% have the benefit of greater stability… you know that next year you’re not going to have a 30% decrease in your salary. I’m not saying it doesn’t happen, due to layoffs and salary reductions, but the possibility of it happening are less than the risk investors take. For example, in the Facebook IPO, those investors have lost about half. Imagine a top 1% making a $500,000 investment and within 6 months, losing $250,000.

which shows a similar pattern as the graph in the first chart but the top line is not skewed. In addition, the later percentages are compounded by earlier years. I would like to take a relative measure to prove a point… from 2001 to about 2002, the top 1% had a decrease of about 30% in earnings while the <90% had no change in their wages. From 2000 to 2007, top 1% only had a 1% increase in earnings while <90% had a 9% increase. From 2007 to 2009, top 1% had a decrease of 16% while <90% had a decrease of 9%. In the lost decade, from 2000 to 2010, top 1% had a decrease of 9.5% in annual revenue while <90% had lost less than 1% (pretty much no change). I’m not denying the fact that top 1% have increasingly earned more, but the fluctuations for the top 1% are greater. Top 1% earners tend to be heavily invested in businesses and markets. These investments inherently carry great risk of potentially losing capital. <90% have the benefit of greater stability… you know that next year you’re not going to have a 30% decrease in your salary. I’m not saying it doesn’t happen, due to layoffs and salary reductions, but the possibility of it happening are less than the risk investors take. For example, in the Facebook IPO, those investors have lost about half. Imagine a top 1% making a $500,000 investment and within 6 months, losing $250,000.

I’m not outright defending one position or the other, but I feel that better context and analysis is needed when viewing these graphs. For example, productivity is highly influenced by the adoption of technology which would have an impact on business revenue and thus increase the earnings for investors but not so much for the employees.

Some might wonder why I’m defending the Top 1%. At heart, I’m an entrepreneur and capitalist. It’s not so much that I’m defending the top 1% as it is that I’m defending the principles of capitalism. A lot of what I’ve mentioned is impossible to communicate through just one graph. It’s something that requires in-depth analysis and discussion.

I encourage discussion of opposing views on political topics because through that process we learn, grow, and progress. Unfortunately our political system has broken down to one-liners, taking things out of context, and shock tactics which undermines understanding and growth. I blame both political parties for the mess we’re in. It seems that compromise and understanding has yielded to extreme polar opposite stances and exaggerated claims in order to fulfill political agendas.

Scottrade is Raising Fees and Adding a Transfer Fee

Sep 11th

Today I received a notification in my Scottrade account of a new brokerage commissions and fees schedule. According to their message:

Effective Oct. 1, 2012, we are updating our Commissions and Fee Schedule. Please note that no changes have been made to commissions for orders entered online.

Overall their statement is true. Price increases are seen for IVR phone system (almost doubling) and broker-assisted orders. Online stock and ETF orders remain at $7. Their mutual fund rates remain the same as well.

However if you look closely at their Service Fees, you’ll see an increase in many of their services plus one additional one: Account Transfer (Full Transfer) for $75.

Scottrade was not charging for account transfers till now. Don’t get me wrong, I still like Scottrade and they do have some of the lowest commissions out there. In addition, all the other major online brokerage firms were charging transfer fees already ranging from $60-$75:

- Schwab: $70 fee

- Ameritrade: $75 fee

- eTrade: $60

- Scottrade: $75 (used to be $0)

So it’s no surprise Scottrade decided to add a transfer fee. A transfer/closing fee would really only affect you if you were switching from one brokerage to another or closing out your account completely. I just found it interesting how there was no mention of the additional fee without digging into their fee schedule.

Overall I still enjoy Scottrade and won’t be switching. However I will be considering opening an account at Ameritrade given their extensive list of no-commission free ETF’s including Vanguard; I’m just not sure if I’ll be jumping into the ETF marketing any time soon. My portfolio has grown to the point where I feel I can diversify adequately and gain a better return than an ETF.

If you’re looking to getting started at Scottrade with some extra free trades, feel free to use my referral code:

Sometimes a Deal isn’t a Deal on Daily Deal Sites Like Groupon and LivingSocial

Sep 2nd

I just received an email on today’s LivingSocial Deal for a “Shazzam Tsunami Rechargeable Electric Hydroflosser with Included Shipping“:

LivingSocial claims a 72% savings. So you would think this is definitely a great deal. Imagine getting something for $64 that was originally $231. However this is clear deception because I found the exact same product on Amazon.com for less… a lot less… almost half of the LivingSocial deal.

You can get the Professional Rechargeable Oral Irrigator with High Capacity Water Tank by ToiletTree Products on Amazon.com for a mere $39.95.

As the group discount sites deal with slower traffic and businesses that are realizing that it may not be to their benefit, they’re are desperately trying to turn an income by no longer delivering value to their target base; which ironically will be the demise of these group coupon sites. I feel for the 142 and counting people who have purchased the inferior LivingSocial Deal.

Recently I’ve turned my attention to FatWallet who’s overall goal is to deliver value to their target base. I also found a very strong community of people who are actively looking for value in their purchases. I would say, put these “Groupon” sites on the backburner and give FatWallet a try… perhaps you’ll find real value instead of a “deal” that’s not really a deal.

Personal Workout Challenge: August Performance – Back on Track

Sep 2nd

After not meeting July’s goals, I became more disciplined in keeping with my swimming. There were times that I just felt tired after working and my mind briefly tried to talk myself out of swimming for that day; coming up with the reasoning of, “Well I’d just not do it today and make up for it tomorrow.” In July I would succumb to it but this time I would lash back and say, “No, I’m going no matter how tired I am.” I realized that as soon as I got out at the pool, somehow from somewhere my body would find the energy. Any moment that I felt weakness coming upon me with the thought of giving up, I would dig deep and find whatever last bit of energy I had left and kick back. This was really what helped me stay on track this month.

With my routine of eating healthy and swimming three times a week, I’m glad to say that I’m back on track to meet my end of the year goal. It’s still not going to be easy, but by meeting most of August’s goals, I’m one step closer.

| ABDMN | ARMS | CALF | CHEST | HIP | NECK | THIGH | WEIGHT | FAT% | |

|---|---|---|---|---|---|---|---|---|---|

| PREVIOUS | 33.25 | 11 | 13 | 38.25 | 35.75 | 14.5 | 20 | 129.6 | 11% |

| GOAL | 32.5 | 11.5 | 13.5 | 38.25 | 35.5 | 14 | 20.5 | 128.0 | <10.5% |

| ACTUAL | 32.25 | 11 | 12.75 | 38.0 | 35.25 | 14 | 20 | 127.6 | 10.3% |

See Complete Personal Fitness Log

Notes to Consider

- While I originally thought that there was very little fat in my calves and chest, it seems that there was some; who knew. So my initial thought that I would be adding inches while swimming was a bit unrealistic. Even though I didn’t meet my goal of an increase, I’m overall satisfied that there was a decrease and consider it a step forward.

- If I’m to reach 27in on my abdomen by year end, I’ll have to be losing about 1.25in per month. It’s a bit aggressive but I think it’s doable with this month’s 1in loss on just swimming 3x a week for about 30-45min.

- As the cooler weather comes around, I’ll stop swimming but will begin my exercises with the weights and resistance cords. The different type of exercising will help me develop the arms and chest; at least that’s the plan. I’ll still be swimming for about half of September.